Top Sales Strategy for Beauty Brands in China

In the dynamic 2024 landscape of China’s beauty industry, navigating the complexities of e-commerce and distribution can be a formidable challenge for brands looking to establish or expand their presence.

Cost-Effective Agency

KPI and Results focused. We are the most visible Marketing Agency for China. Not because of huge spending but because of our SMART Strategies. Let us help you with: E-Commerce, Search Engine Optimization, Advertising, Weibo, WeChat, WeChat Store & PR.

GMA (Gentlemen Marketing Agency), a specialized agency dedicated to helping beauty brands succeed in the intricate Chinese market.

This article explores the strategic transformation and sales tactics that have propelled in China, and the case studies of Pechoin to success in the competitive beauty market in China.

Beauty Brands: from Offline to Online Dominance

Online Ascendancy: A Strategic Overhaul

This section delves into the tactical shift Pechoin undertook post-IPO, focusing on the online market. It explores the brand’s strategic decision to target the e-commerce space, marking a departure from its traditional offline channels.

Balancing Offline Roots with Online ecommerce Growth

This part examines the challenges and strategies involved in balancing Pechoin’s established offline presence with its booming online sales. It discusses the initial dual approach of managing flagship stores and distributor-led online sales, and the subsequent adjustments made in response to market dynamics and distributor feedback.

Read more

The Impact of Going Digital: Direct Online Sales and Customer Engagement

Focusing on the transformative effects of Pechoin’s online strategy, this section analyzes how direct sales through e-commerce platforms led to a more customer-centric approach. It highlights the changes in customer service, brand building, and price management that came with this digital shift.

Market Expansion and Demographic Shift: Reaching a Broader, Younger Audience

Concluding with the results of Pechoin’s strategic overhaul, this part examines how the brand successfully expanded its market reach and altered its customer demographic profile. It underscores the brand’s growth from targeting affluent women in smaller cities to encompassing a broader, younger audience across all urban tiers in China.

Marketing and Operations: Adapting Swiftly to Market Dynamics

- Kantar’s Analysis: An analysis by Kantar on Chinese brand marketing revealed that a 50% reduction in a quarter’s media budget leads to a 19% decrease in brand activeness. A quarter without any media investment results in a 52% drop in brand activeness, and not investing in media for half a year leads to a direct 13% decrease in brand sales.

- Pechoin’s Understanding: While these statistics may not be specific to the beauty industry, Pechoin seems well aware of them. In the past three years, Pechoin’s marketing expenses were 1.497 billion yuan, 1.992 billion yuan, and 2.786 billion yuan, with the sales expense ratio reaching 39.9%, 42.98%, and 43.63% respectively. Concurrently, Pechoin has been actively exploring the most effective marketing and operational strategies to maximize profits.

- Read more

From In-Platform to Off-Platform Marketing

- Taobao’s Role: As a primary platform for offline brands transitioning online, Taobao is where brands, including Pechoin, focus their marketing efforts. In-platform advertising offers clear conversion paths and data, making ROI easy to monitor.

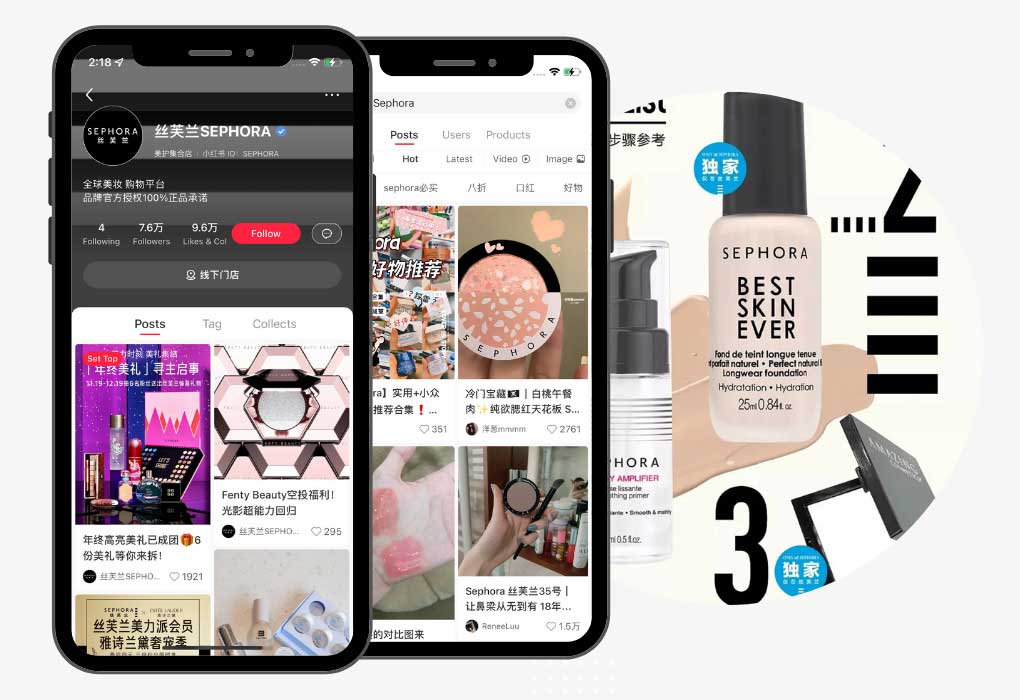

- Shift in Strategy: Due to a shift in the e-commerce and social media landscape, Pechoin faced challenges with in-platform ROI, leading to a 1.2-1.5 times increase in customer acquisition costs. Consequently, Pechoin gradually shifted its marketing budget from in-platform to off-platform channels, including Douyin, Xiaohongshu, Weibo, WeChat, and various websites and vertical interest platforms.

- Sales Expense Ratio: From 2018 to 2023, Pechoin’s sales expense ratio gradually increased, stabilizing at around 43% in 2022 and 2023. In-platform advertising accounted for 25-35% of total sales expenses, while off-platform advertising took up 60-70%. Of the off-platform budget, half went to Douyin and Kuaishou, with Xiaohongshu taking 20-30%, and Weibo and WeChat each accounting for 5-10%.

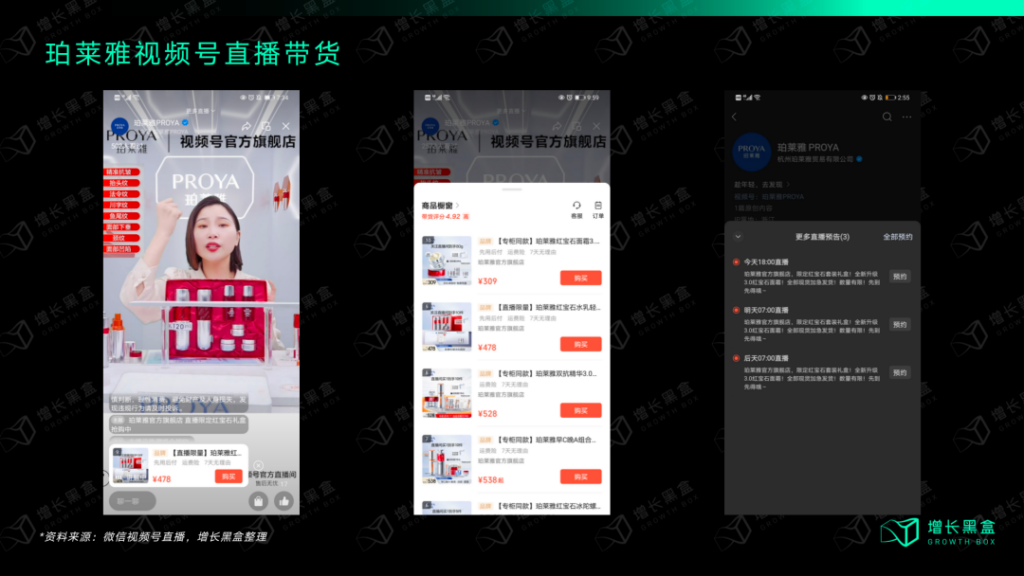

From Influencer to Self-Broadcasting

- Changing Taobao Landscape: The rise of top influencers like Li Jiaqi and Wei Ya has significantly impacted in-platform traffic, making brands’ situations more passive. In 2019, influencer-led live streaming accounted for 80% of Pechoin’s live streaming GMV. The downside of influencer broadcasting is the demand for lower discounts and high slotting fees, often taking up 30-40% of sales revenue.

- Pechoin’s Response: To address these issues, from 2020, Pechoin focused on two approaches: Communicating with niche influencers with smaller fanbases and adjusting the balance between influencer-led and self-broadcasting, emphasizing the latter.

Public to Private Domain Shift

- Matrix Account Operation: To combat the decreasing traffic problem, Pechoin operates matrix accounts on various platforms, using public domain traffic to gradually shift to a private domain model. These accounts are managed by different business departments, each with distinct business logic and goals.

- Douyin’s Role: Pechoin places high importance on Douyin for aligning with current consumer preferences for short video content and facilitating both advertising and sales conversions on the same platform. Sales on Douyin have rapidly grown over three years, especially in October, boosted by Double 11 presales.

- Consumer Demographics: Pechoin’s consumer base is becoming younger and more diverse in terms of city tiers, thanks in part to Douyin. Data shows that 60% of Pechoin’s consumers on Douyin are aged 18-30, and this demographic is continually growing.

Read more

Conclusion: The Resilience of beauty in Market Transformations

- Brand Evolution: Brand ability to adapt to market changes has been crucial. However, there are potential risks ahead, including increased competition in marketing investments and the high cost of nurturing new brands without immediate profitability.

- Potential Opportunities: Pechoin’s future growth may hinge on continued innovation in digital and refined marketing strategies, including exploring new opportunities in video platforms.

GMA stands at the forefront of digital marketing and distribution strategies, specializing in platforms like Douyin (China’s TikTok) and Xiaohongshu (Red), which are pivotal in the Chinese beauty market. With a deep understanding of e-commerce dynamics and consumer behavior, GMA offers comprehensive services tailored to the unique needs of beauty brands. From developing engaging marketing campaigns on China’s leading social media platforms to navigating the distribution channels, GMA is the partner of choice for brands looking to tap into the burgeoning Chinese beauty market.